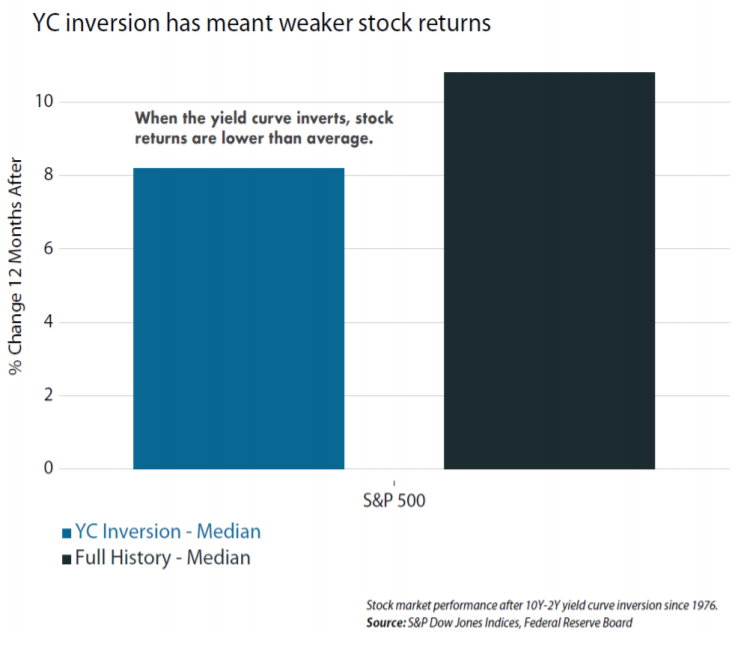

Economic growth and stock returns have been weaker one year later

MAIN POINTS

An inverted yield curve is not a sufficient condition for a U.S. recession.

Tight financial conditions and/or weakness in the services sector would increase recession risk more meaningfully.

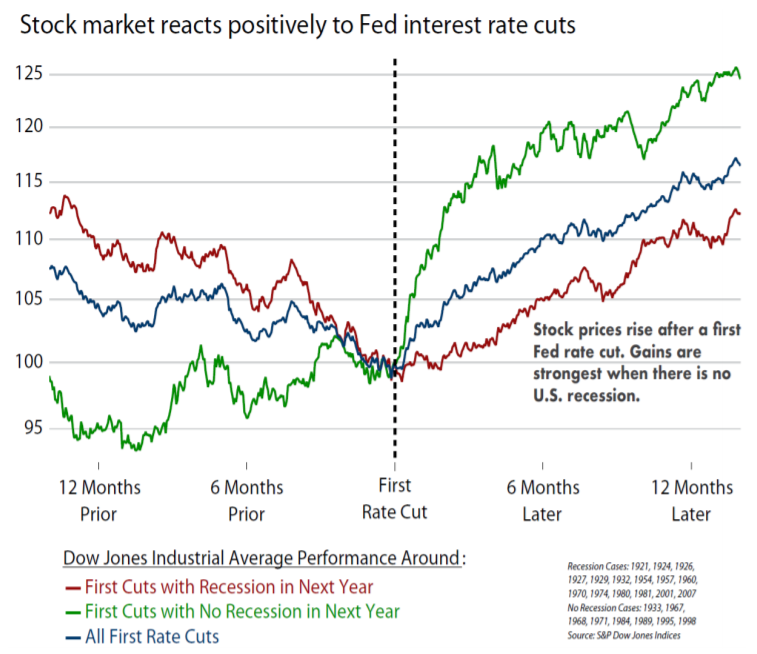

Inversion has been followed by inc...

September 09, 2019 04:00 PM - Comment(s)